Hello! And welcome to October News. We find ourselves at several crossroads : summer to fall, third quarter to fourth, and the promise of a new federal budget. Well, almost. Congress passed a continuing resolution for 45 days to give itself a bit more time to come up with a budget for the year.

💰

The last threat of a shutdown was over approving a new debt ceiling limit. This one is over the failure of Congress and the President to approve a budget for the coming year. The government runs on a fiscal year that begins October 1. We can only operate the government and pay federal employees if we have an approved budget.

So, what happens now? Congress needs to approve an annual budget by November 17 or pass another continuing resolution or risk another shutdown. A shutdown means a furlough of federal employees, and services deemed non-essential will cease. Those deemed essential will continue, and their employees will be required to work without pay until the budget is passed. This will put pressure to act, but the last time it happened, it took 35 days. How the near shutdown affects us and the economy remains to be seen. Don’t be surprised if there is some upheaval in Congress before this is all over.

🤼♂️

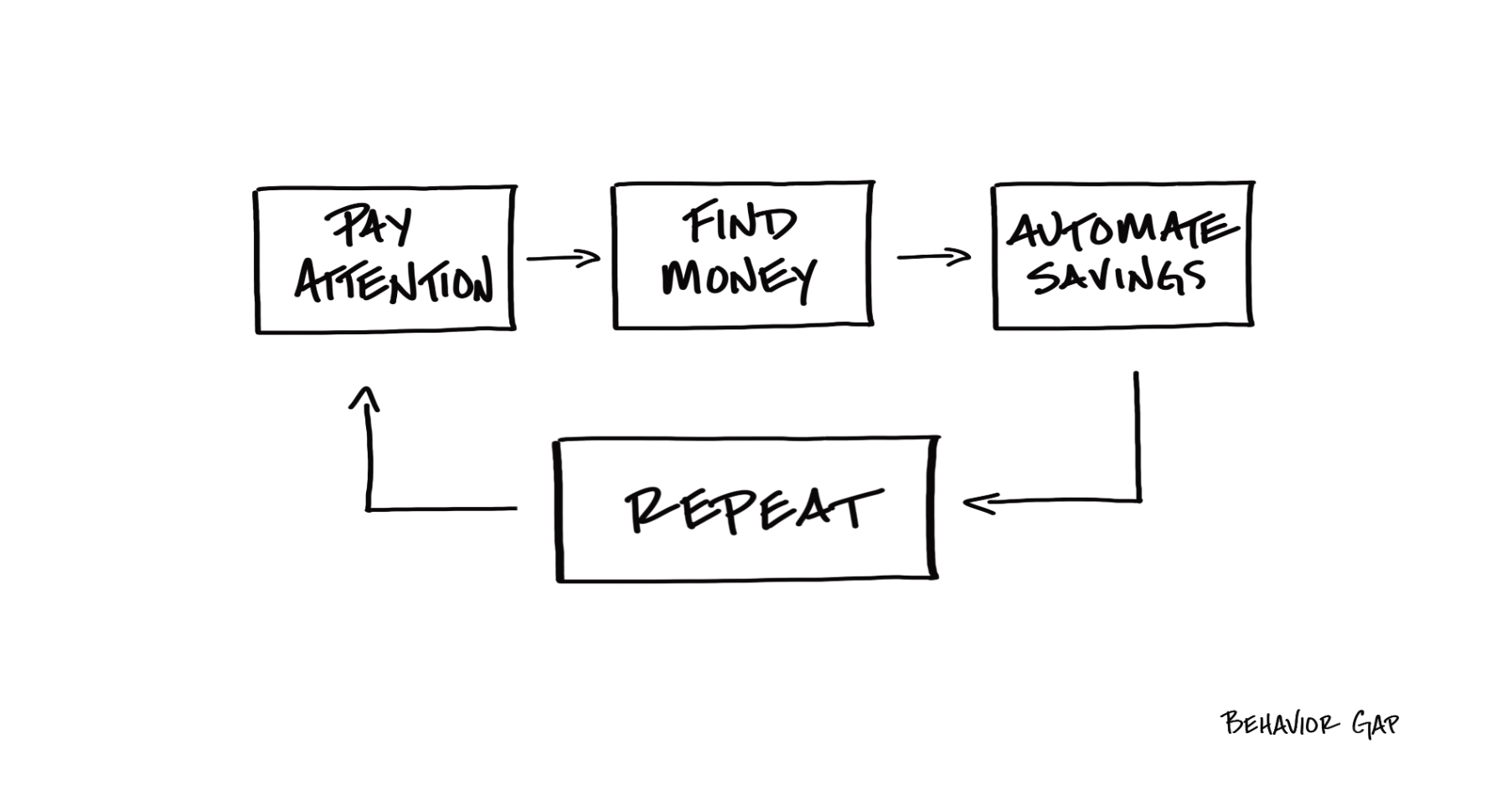

How important is a household budget? Many of us resist a budget because it feels like we are denying ourselves. The word “budget” often triggers us because it comes from a lack or scarcity mindset. “Budget, you’re not the boss of me.” I often suggest an expense worksheet instead. Where a budget feels like, “I can only spend this much on that,” an expense worksheet is more of an allocation of resources. “This is how much I am willing to spend on that.” Some people feel comfortable with a loose outline. Others track every penny. Either works. It is a matter of preference.

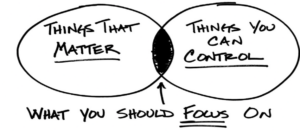

Our expenses fall in the category of what is important and what we can control. What Congress does or doesn’t do is outside our control. What the markets do is not in our control. Often, clients focus on their rate of return, which is important, but relies on the market and is only partially in their control. You can control how you invest your money. How you allocate those investments is in your control, but how that particular asset performs is not within your control. I am not saying you can’t look for high-probability opportunities, just that the outcome is not in your control. To finish this thought, you can control how much you spend and save. You can decide how to allocate your investments, but how those assets perform is out of your control.

The financial planning process is mainly about helping you focus on what you can control and letting go of what you can’t. It provides clarity so you can make better decisions.

If we can help you with your decision-making around your finances, we are here to help. 🏆

And, just for fun, here are a couple of pics from our recent trip to Mexico. I hope you had a great summer!