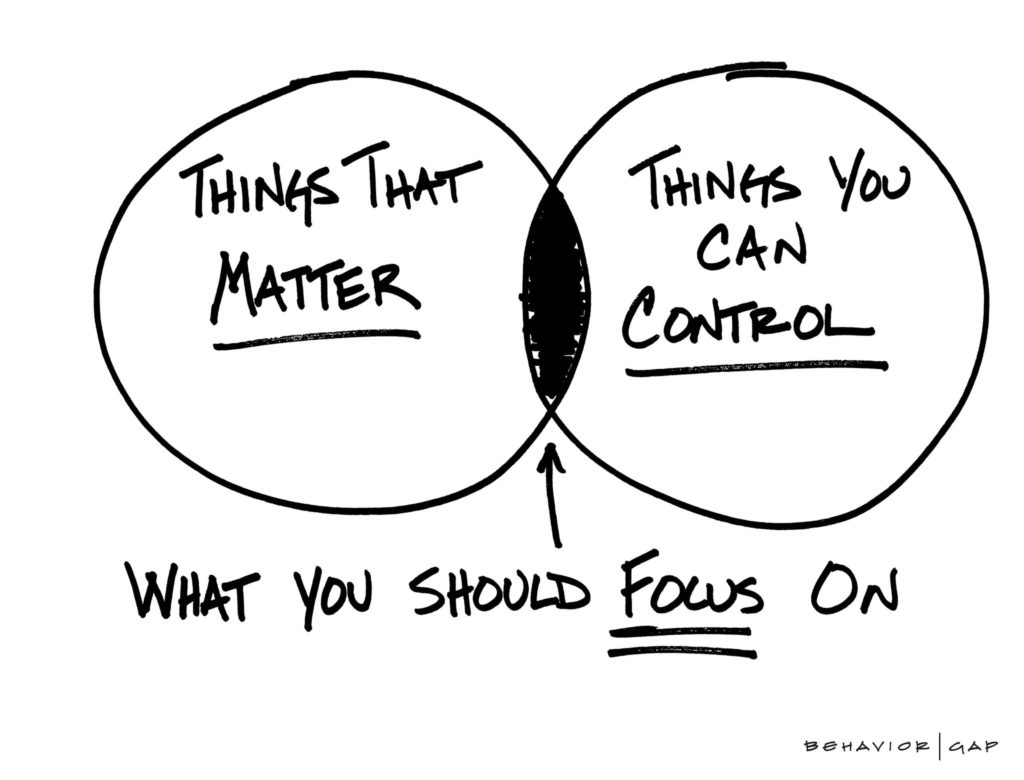

Carl Richards, CFP, a well-known author in investor education, created the graphic above. Many of you have heard me say this and may have seen this illustration. I first saw it in a paper put out by Vanguard, the mutual fund, and investment management company. The article was developed by Vanguard to highlight the value a good advisor can bring by helping clients focus on what is essential and what they control. You can download the paper here.

While I usually speak about this to clients with respect to their planning and investments, I think it is appropriate to talk about it in the context of COVID-19. Yes, I have avoided talking about it mostly because I am not qualified and because I don’t think anyone knows how it is going to impact our economy in the long term and our investments in the short and long term.

We just posted one of the worst gross domestic product numbers (GDP) maybe in history and yet the Dow Jones Industrial Average, a broad measure of the stock market, closed down just 226 points.

Here is another outlook on the US economy’s rebound: US Economy’s Rebound Looks Shakier After Worst Quarter Yet (Bloomberg)

It is almost unimaginable that the US economy produced 1/3 less this quarter what it did this quarter last year.

So how do we apply the above to our current situation? We can’t control the market, so let’s focus on what you can control.

You can control how you invest. We do this with how we allocate our savings and investments. It is tempting to sell it all and go to cash and wait for this to blow over, but we don’t know what the market returns will be, so we don’t know if going to cash is the right decision. And we create a second problem of when to go back into the market. We will mostly time both badly. Here’s a video we created to explain risk tolerance.

We can control how we spend our money. Many of us are eating at home and fixing our meals, which saves money and improves our health. We can look at our other spending and question what we really need. We sold one of our cars this month because we are both working from home and it is infrequent, we both need to go somewhere. Sure, this will change, but I am not sure we will ever return to driving as many miles as we used to.

We can control how well we take care of ourselves. Eating right, sleeping enough, and getting exercise may help build our immune system and ward off viruses and other health issues. Studies are coming out that certain supplements like Vitamin D may help strengthen our immune system as well, and as many as two-thirds of us may be deficient. (Studies located here and here.)

We could be a lot healthier as a nation.

There are lots more ways we can focus on what we can control. I listed a few that came to mind. I encourage you to think about what is important to you and what you can control and worry less about the rest. Worry won’t help anyway.

Here are some more resources for you to read including the Vanguard article on your advisor’s alpha.

Putting a Value on Your Value: Quantifying Advisor’s Alpha, Kinniry JR, Jaconette, DiJoseph, Zilbering, and Bennyhoff

Tapping into Wealth, Margaret Lynch

Discover Your Purpose, Rhys Thomas

Thinking Fast and Slow, Daniel Kahneman

You are a Badass at Making Money, Jen Sincero

I Will Teach You to be Rich, Ramit Sethi

The Science of Getting Rich, Wallace Wattles

Your Money or Your Life, Vicki Robin

The links provided are for educational purposes only. The links do not represent an endorsement by either Hicok Financial Solutions or ProCore Advisors, LLC.