Each month, I write this letter to you, our clients, partners, and friends to let you know that I care about you and am thinking about you. Once in a while, I come up with something pithy to say, but usually begin like this:

“Where do I start?”

🧐

I am sure you are near exhaustion with the news of late, so I won’t review it all here. For about 18 months, we have been under the threat of recession. I want to reference The Sword of Damocles here, not just to show you how smart I am, but because it is a fitting reference to our economy. Just yesterday, I read an article about the Four Horsemen of the Economy that might lead to the market meltdown, two of which have been met. I could argue that three have been met, but I will let you be the judge.

According to the article, they are:

- extended valuations

- interest rate pressure

- recession

- destabilizing events

Extended valuations have to do with stock prices relative to their earnings. For example, Tesla and Amazon trade nearly 70 times annual earnings. Think of it like this: I have an apartment building that I want to sell. At my current asking price it will take the buyer 70 years to recover their initial investment from the rents collected. Another example is JPMorgan, which trades at about eight times earnings, as do many bank stocks. This is not a recommendation, merely an observation.

Interest rates have climbed, the understatement of the year. The 10-year treasury touched 5% this week, and mortgages nationally are nearly 8%.

Recession is the thing everyone has been talking about when they are not hoping for a soft landing. Recession will surely come as it always does, just as Dionysius tried to demonstrate to Damocles that the fortunes of men who hold power are precarious. The economy will enter a recession. What we don’t know is when and for how long.

And, finally, without getting too doom and gloom, we are experiencing destabilizing events. Our geopolitical situation is precarious. Tensions in the Middle East could lead to a global confrontation with countries choosing sides. I’ll leave it at that.

🌎 🌍 🌏

So, what should we do?

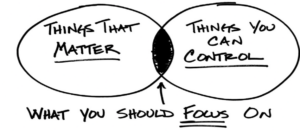

It’s tempting to go to cash and hope the whole thing blows over. But, this is not a recommendation. I bring you back to previous posts where instead I recommend you revisit your appetite and assess whether your investments align. And, we can help with that. Focus on what is important and what you can control. Schedule some time with us if you haven’t already, and position yourself to meet your goals. We have some great new tools and are happy to share them.

As always, we’re here for you.

David

https://calendly.com/david-hicok/60-min-zoom