What is your goal? To live a long time?

Or is it your goal to live as healthy as possible for as long as possible?

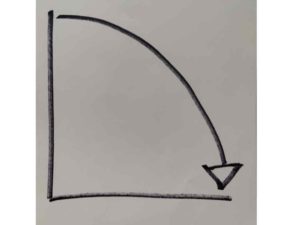

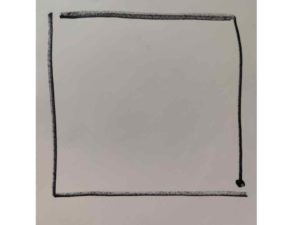

I have been engaged in an inquiry about my health in earnest for about a year and a half. During the pandemic I started working out with a longtime friend who I worked with in finance and then went into personal training to follow his passion. We started outdoors at the beach which was a real treat because we were just out of a lockdown and I was a bit stir crazy. Then came the Peloton in the garage. And all the while I subscribed to various health experts about how to live well for as long as possible. Peter Attia describes it best and I will attempt to paraphrase here. We think of our life span as robust in the beginning and then heading toward an inevitable decline in old age, something like this:

But what if it doesn’t have to be this way? What if we could live a life relatively free of disease, with strength, flexibility, and vitality until the end? Something like this:

My art is not great, but I hope you get the idea. What if we could live as well as possible for as long as possible, enjoying health and vitality, and then simply fade away?

Personally, I don’t think the idea of longevity can be separated from living a healthy life, but the planning world doesn’t see it that way.

When you are studying for a designation in financial planning, longevity is just a number, the age when the client will pass away. Planning requires that the planner choose a date when the client will no longer need funds to live. Our default is 95 but the number is arbitrary, like the 10,000 steps. My justification for this is I don’t want to be 94 and run out of money. We have a conversation with every client about family history but the bottom-line is none of us know when we will pass on so this one is tricky. I have had clients pass away in their 70s and in their 90s and everywhere in between. The challenge is that we just don’t know. The four horsemen of financial planning are the four unknowns that can throw us a curveball in planning.

So, what do we do? We have a conversation about family history and longevity. We plan for 95 as a default and then if the family is particularly long lived, we bump that out to 100. We build in a lot of margin for error and we make conservative estimates about our rates of return. Then we adjust as we go. The best defense is to have a large enough nest egg that you cannot outlive it under nearly 100 out of 100 outcomes, but not all of us will have that luxury.

I think back to a newsletter I wrote from quite a while back about focusing on the things you can control : https://www.hicokfinancial.com/how-we-help-you-focus-on-what-you-can-control/ (an idea I borrowed from Carl Richards, CFP). We are all so focused on “what the market will do” that we fail to focus on what we can control, which is how much we spend and save. And the same holds true for longevity. If you want to live a long and healthy life, focus on the things you can control.

If this is resonating for you, here are a few websites I have found helpful, even inspiring. But before I get there let me just say how grateful I am for all of you. What I do is a joy because of you, and I plan on taking care of myself so I can do it as long as possible. ✨

Be good to yourself and those around you and I will strive to do the same.

RESOURCES :

The information provided here is for educational purposes only.